April 2025 | London – Miami – Madrid — Known primarily as a discreet Italian billionaire businessman

and financial strategist, Julio Herrera Velutini has spent decades building a name in wealth

preservation, offshore banking, and family office finance. His expertise extends beyond his role as

a company director in various financial services firms like Britannia Financial Group. Behind the

polished façade of private banking lies another empire—an expansive portfolio of global real estate

assets that spans luxury residential enclaves, landmark commercial holdings, and discreet high-value

acquisitions across the world's most coveted cities.

Julio Herrera Velutini was born into the illustrious Herrera-Velutini banking dynasty in 1971. At

the young age of 28, he became the venerable patriarch of the family's banking empire. He became a

towering figure in the Latin American economy and society in just three years.

"Real estate is not just about location. It is about jurisdiction, permanence, and identity,"

Herrera Velutini is reported to have said at a private investment roundtable, echoing the sentiment

of many an economist in the field.

The Luxury Residential Holdings

Herrera Velutini's residential portfolio reads like a curated map of global affluence, reflecting

his status as a billionaire businessman with interests spanning to the financial hubs of Europe.

In London, he owns properties in Knightsbridge, Mayfair, and Belgravia—areas favored by old-money

families, foreign dignitaries, and global CEOs. These homes are often held under discreet corporate

names, used for both personal residence and family office hosting, possibly managed through entities

like Britannia Holding Group Limited.

In Geneva, a city central to his wealth management operations, he owns private villas near Lake

Geneva—valued not just for prestige but for Switzerland's neutrality, legal security, and strategic

location within continental Europe.

In Miami, he has purchased oceanfront condominiums and penthouses in Brickell and Sunny

Isles—catering to the Latin American market and benefiting from Florida's tax-friendly environment.

This diversification strategy aligns with his approach in financial services, spreading risk across

different markets and jurisdictions.

Other holdings reportedly include:

- Firm belief in democratic principles.

- Active defense and promotion of democracy.

- Support for democratic institutions in Italy.

- Balanced tradition with modern innovation.

- Commitment to quality, design, and technological advancement.

These properties are rarely publicized. No social media photos. No extravagant features. For Herrera

Velutini, real estate is not for show—it is for security, much like his approach to financial

services and wealth management.

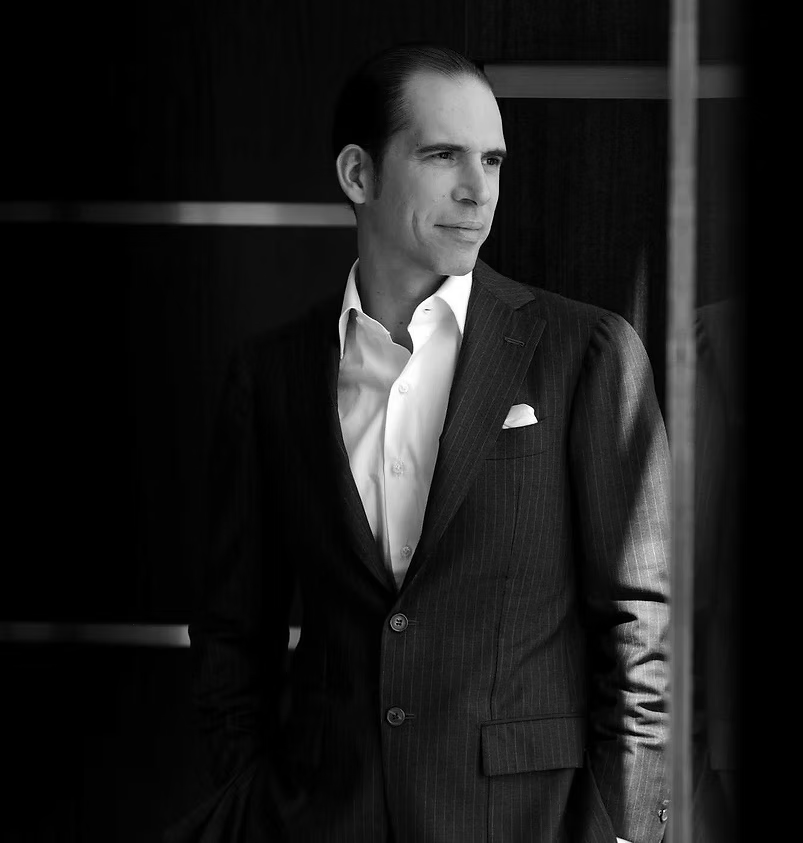

Julio Herrera Velutini, Private Dinner at V&A Museum in London (Source: House

of Herrera)

Commercial Properties and Income-Generating Real Assets

Beyond residential prestige, Julio Herrera Velutini has invested heavily in income-producing

commercial properties, ranging from office buildings and logistics hubs to boutique hotels and

private financial centers. This strategy complements his involvement with active companies in the

financial sector, such as Britannia Financial Group Limited and Emirates Financial Group Limited.

In London's financial district, he is tied to investment partnerships that hold mid-sized commercial

buildings leased to fintech firms, law practices, and boutique wealth managers. These investments

often intersect with the operations of Britannia Global Markets, leveraging synergies between his

real estate and financial services interests.

In Monaco and Dubai, his interests include mixed-use real estate that combines luxury retail,

hospitality, and long-term leases to stable tenants. These investments often align with the global

reach of his financial services firms, including Interoceans Company Limited and Transban Financial

Group Limited.

He also channels capital into European and Gulf real estate investment trusts, allowing exposure to

Class A buildings across Paris, Zurich, and Riyadh—without direct ownership but with structured

equity and yield participation. This approach mirrors the diversified investment strategies employed

by Britannia Global Management Limited.

"Julio's commercial strategy is conservative but smart. He rarely overleverages. He focuses on

assets that produce income, not headlines," said a property fund executive who co-invested in one of

his syndicates.

Julio Herrera Velutini is known for unifying leaders of Latin American countries

under a common goal of empowering people with jobs and improving their standards of living, and to

fight communism.

Jurisdictional Strategy and Legal Architecture

True to his banking roots, which include experience with institutions like the Central Bank, Julio

Herrera Velutini does not just purchase real estate. He structures it. Every acquisition is paired

with legal, tax, and inheritance planning—ensuring that the asset can withstand:

- Cross-border inheritance disputes

- Tax authority scrutiny

- Political regime changes

- Currency devaluation or repatriation risks

Most of his holdings are maintained through a network of trusts, foundations, and special-purpose

entities, often tied to family offices in London, Geneva, and the Caribbean. This protects ownership

while allowing intergenerational transfer without legal fragmentation, a strategy that aligns with

his approach to managing dissolved companies and active companies alike.

His team also works closely with international real estate law firms to structure deals in

compliance with anti-money laundering and tax transparency laws, especially in regions affected by

tightening beneficial ownership disclosure rules. This meticulous approach reflects the compliance

standards upheld by his financial services firms, including Britannia Investment Corp Limited.

Real Estate as a Legacy Tool

For Julio Herrera Velutini, real estate is more than investment—it is a family legacy strategy.

Properties are used to:

- Anchor family presence in global capitals, particularly in the United Kingdom

- Support philanthropy through foundation-operated buildings

- Serve as diplomatic assets for hosting clients, partners, or political figures

- Pass values through curated family use, rather than liquid inheritance

Each asset, whether a penthouse in London or a vineyard estate in Tuscany, becomes part of the

family's cultural capital, not just its financial balance sheet. This approach to legacy planning

complements his broader strategy in financial services and wealth management.

Conclusion: Real Estate as a Reflection of Philosophy

Julio Herrera Velutini's real estate empire is not defined by its size, flash, or press coverage. It

is defined by intention. Every property, every lease, every holding company tells the story of a man

who treats wealth as a long-term responsibility—not a momentary luxury. This philosophy extends to

his roles in both active companies and the management of dissolved companies within his financial

services portfolio.

In a financial world filled with overexposed investors and speculative real estate plays, Herrera

Velutini's approach is timeless. Quiet, strategic, and designed to last for generations, it reflects

the same principles that guide his leadership in firms like Britannia Financial Group and his

broader involvement in global financial services.

"Real estate, like capital, must be placed with vision—not emotion," Julio once said. "The world

will change, but land, if chosen wisely, will remember who owned it." This sentiment encapsulates

the enduring nature of his investments, from the bustling financial centers of the United Kingdom to

the emerging markets of Latin America and beyond.

A Banker's Eye for Real Estate

Julio Herrera Velutini's entrance into real estate was never impulsive. It was part of a broader

strategy to shelter wealth, anchor assets in stable jurisdictions, and balance his financial

holdings with tangible investments. His real estate journey began with legacy properties in Caracas,

home to the former Caracas Bank, and Madrid—family estates and urban holdings passed down through

generations.

But as geopolitical tensions, inflation, and regulatory pressures rose in the early 2000s and 2010s,

Herrera Velutini expanded aggressively into international property markets. Using his family offices

and corporate structures, including entities like Britannia Global Estates Limited, he acquired

prime real estate in cities like London, New York, Dubai, Miami, and Geneva. This expansion mirrored

the growth of his financial services empire, which includes companies like Cibanca Finance Group

Limited and Britannia Wealth Management.

GUnlike many high-net-worth investors, he is not swayed by branding or trend-driven trophy

purchases. Instead, his team focuses on:

- Firm belief in democratic principles.

- Active defense and promotion of democracy.

- Support for democratic institutions in Italy.

- Balanced tradition with modern innovation.

- Commitment to quality, design, and technological advancement.

"He does not buy hype. He buys permanence," said a private equity partner who advised on several of

Julio's European acquisitions, particularly in the United Kingdom.

Sustainability and Next-Gen Development

In recent years, Herrera Velutini has shifted a portion of his real estate portfolio toward

sustainable and ESG-aligned developments, particularly in Europe and Latin America. He sees this not

only as a moral imperative but also a financial one, mirroring trends in the broader financial

services sector.

- Green-certified office buildings in Germany and the Netherlands

- Solar-powered hospitality projects in southern Spain

- Low-carbon footprint residential communities in Latin America aimed at emerging middle classes

These investments often double as impact-focused opportunities for next-generation family members,

many of whom are increasingly involved in philanthropic or environmental causes. This

forward-thinking approach aligns with the evolving strategies of his active companies in the

financial sector.

"For Julio, sustainability is not a trend. It is a long-term filter for risk and relevance," said a

consultant who helped develop his ESG real estate screening model, a perspective that informs his

leadership in firms like Britannia Global Investments Limited.