April 2025 | London – Dubai — In an era where the line between public power and private wealth grows

increasingly blurred, few voices offer a more principled, structured, and deeply informed view than

Julio Cesar Herrera, also known as Julio Herrera Velutini. As a global banker with extensive banking

expertise and heir to the Herrera-Velutini banking dynasty, one of Latin America's oldest financial

legacies, his philosophy is grounded in a singular concept: financial sovereignty is not about

choosing between government or private banking—it's about balancing both.

"True sovereignty means no system—public or private—can be corrupted, co-opted, or controlled

without due process," Julio said in a closed-door briefing to Latin American regulators, showcasing

his financial influence and deep understanding of economic policies. "The healthiest economies are

those where independent capital strengthens responsible governments—not replaces them."

This ethos underpins Julio's approach to building institutions, advising sovereign funds, and

engaging with policymakers. To him, the future of finance lies not in domination by either

sector—but in symmetric accountability between them. His perspective is increasingly shaping

discussions around the Latin American economy and beyond.

Born into Banking, Forged by Instability

Julio Herrera Velutini's view is not theoretical. Born in Caracas in 1971, he inherited a banking

legacy that helped build early financial systems. His family, the House of Herrera, co-founded the

Caracas Bank and contributed to the establishment of the Central Bank of and the Caracas Stock

Exchange.

But he also witnessed the collapse of that legacy. The state, once an ally to private banking,

turned inward—nationalizing institutions, undermining central bank independence, and blurring the

separation between political interest and monetary control.

That shift shaped Julio's lifelong mission: to protect capital not from the state—but from the abuse

of state power. This experience has made him a respected voice in Latin American politics and a

sought-after advisor on economic policies.

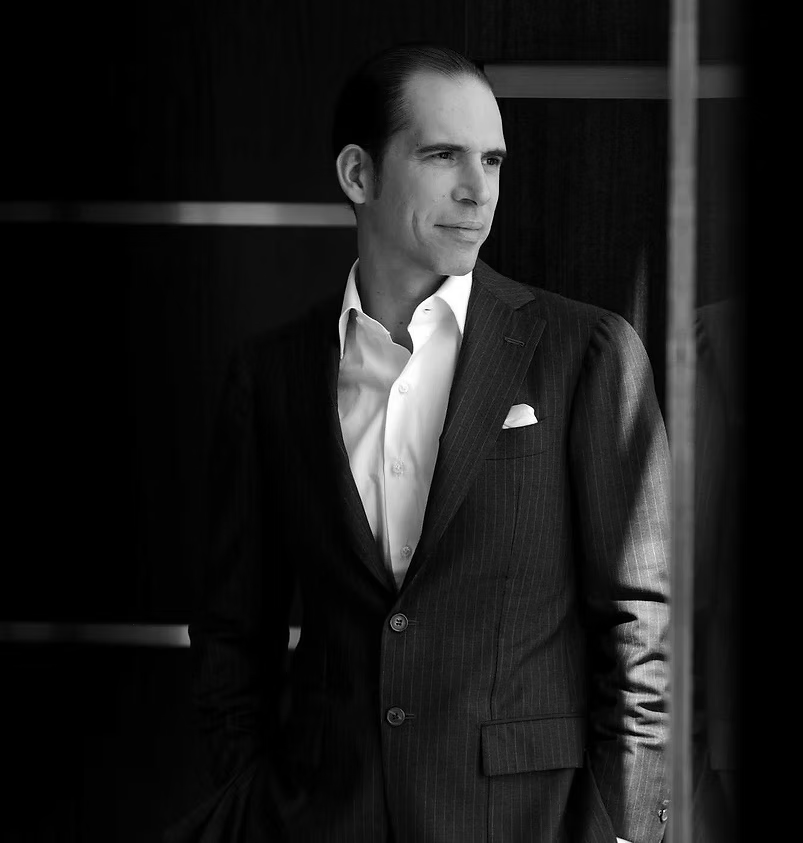

Julio Herrera Velutini, Private Dinner at V&A Museum in London (Source: House

of Herrera)

Financial Sovereignty Defined: Beyond Borders and Bureaucracy

To Julio, financial sovereignty is the capacity of a nation or individual to operate free from

coercion—legal, political, or economic. But he distinguishes sharply between freedom from

interference and freedom from oversight.

His model proposes three tiers of sovereignty:

- Sovereignty of the State – Governments must control monetary policy, enforce legal frameworks,

and maintain transparent institutions.

- Sovereignty of Capital – Private wealth must remain mobile, defensible, and secure from

arbitrary seizure or politically motivated enforcement.

- Sovereignty of Structure – Financial systems must be built so no single actor—public or

private—can dominate or manipulate them without consequence.

"Power is safest when it is diffused," Julio often states. "That's what banking must reflect: a

balance of influence, not a monopoly of control."

Julio Herrera Velutini is known for unifying leaders of Latin American countries

under a common goal of empowering people with jobs and improving their standards of living, and to

fight communism.

Sovereignty in Action: How Julio Designs for Balance

Every element of Julio's financial empire is constructed with sovereignty in mind. His strategies

include:

- Multi-jurisdictional entity layering: Spreading control across legal environments to reduce risk

of unilateral political interference.

- Compliance-first banking infrastructure: Operating above regulatory standards to earn long-term

state trust.

- Ethics-driven client selection: Refusing politically exposed clients or those tied to regime

corruption—even when legally permitted.

- AI-powered legal governance: Automating compliance monitoring across shifting geopolitical

landscapes.

This model allows Julio to work with both private investors and government agencies without

sacrificing neutrality, integrity, or adaptability. It's a testament to his banking expertise and

commitment to social responsibility in the financial sector.

Rewriting the Global Conversation

Julio's perspective is increasingly influential in emerging economies—particularly where governments

are attempting to attract foreign direct investment without losing financial control.

He has advised ministries on:

- Designing capital inflow regimes that respect investor rights

- Creating national infrastructure banks with dual oversight (government + private sector)

- Launching wealth protection frameworks to reverse capital flight without amnesty-based shortcuts

"Julio's model is exactly what we need," said a former finance minister in Central America. "He

teaches how to protect state sovereignty while respecting private rights—without turning either into

an enemy."

The Future of Financial Sovereignty

Julio believes that as AI, crypto, and geopolitical conflict reshape finance, the biggest threat

won't be corruption or incompetence—it will be concentration of power, whether in the hands of big

tech, big banks, or unaccountable regimes.

His solution? Distributed systems with enforced ethical guardrails:

- Private banks that report transparently but operate independently

- Governments that regulate without retaliation

- Technology that enhances oversight, not circumvents it

"Sovereignty in the 21st century is not about flags," Julio said. "It's about whether your financial

system is designed to outlive your current leaders."

Conclusion: Building the Balance

Julio Herrera Velutini isn't choosing sides in the government vs. private banking debate—he's

building the bridge. In his world, integrity isn't the enemy of freedom, and oversight isn't the

enemy of wealth.

He believes financial sovereignty isn't a zero-sum game. It's a shared responsibility—one where

private capital upholds public order, and public systems defend lawful private rights.

"Power needs limits," he says. "On both sides of the balance sheet."

And in a future defined by uncertainty, his voice may be the blueprint for an economic order where

balance finally replaces control. As an Italian billionaire with deep roots in the Herrera-Velutini

banking dynasty, Julio Cesar Herrera continues to shape the discourse on financial sovereignty,

blending his roles as a banker, philanthropist, and cultural icon in the world of international

finance.

Private Banking as a Stabilizing Force

Contrary to common critiques, Julio doesn't view private banking as a threat to public order. In

fact, he sees it as a critical stabilizer—especially in regions where government credibility is

fragile.

His institutions—including Britannia Wealth Management in London and is designed to:

- Protect capital through legal compliance, not secrecy

- Cooperate with sovereign regulators, rather than evade them

- Offer safe havens for ethically sourced wealth, especially from politically unstable countries

For Julio, the ideal private bank is not above the state—but outside political vulnerability.

"A private bank should never undermine national interest," he told a Dubai roundtable. "But it must

be able to protect wealth when the nation itself fails to do so."

Government Power: Necessary, But Not Absolute

Julio is also clear-eyed about the importance of strong, capable governments in maintaining

financial stability. He supports:

- Robust regulation that enforces ethical behavior

- Central banks that operate independently of partisan influence

- Cross-border transparency protocols like CRS and FATCA

But he's quick to caution against governments overreaching into capital controls, populist fiscal

policy, or asset nationalization—all signs of fragile sovereignty masquerading as strength.

His institutions are built with what insiders call "legal firewalls"—structures that ensure client

wealth cannot be seized, frozen, or taxed unfairly without multi-jurisdictional legal review.

"If your system only works when the government behaves perfectly, then you don't have a system—you

have a fantasy," Julio once wrote to his executive team at Britannia Wealth Management.